Understanding the proposed property tax increase in Biddeford: Exploring key drivers and highlighting the broken nature of our tax system

|

|

Liam LaFountain COURTESY PHOTO

|

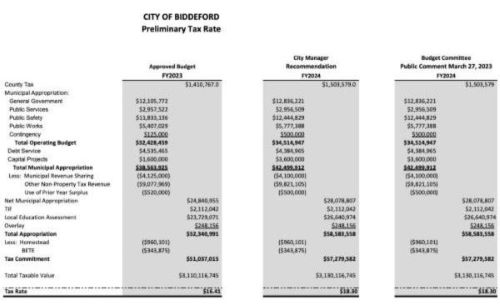

As the new fiscal year approaches, residents in Biddeford are understandably concerned about the proposed increase in property taxes. Earlier this month, the Superintendent and City Manager presented their proposed budgets to the City Council, with the School Budget calling for a 12.3% increase ($2.9 million higher than last year) and the Municipal Budget proposing a 12.9% increase ($3.2 million higher than last year).

In addition, the County Tax will be 6.6% higher than last year. Thus, after factoring in the increase in total taxable value in the City, the proposed tax rate is $18.30 - representing an 11.5% increase from last year’s tax rate of $16.41.

Whether you choose to attend City Council Budget Committee meetings in person at City Hall or remotely via Zoom, they are open to the public. As we work towards balancing the priorities and needs of Biddeford residents with the fiscal realities and inflationary pressures of this budget, your thoughts and ideas are invaluable. Please share your feedback, comments, and questions with us as we progress through this process.

In light of the considerable proposed rise in property taxes, it is crucial to clearly understand the key factors contributing to this increase. While the goal of this budget is to maintain current service levels, it is worth noting that the City Manager has not requested any funding for additional positions. Unsurprisingly, many of the same inflationary pressures affecting residents' household budgets are also impacting our municipal budget.

Some of these factors include:

- Utilities & Fuel increased by 14%. The Community Center will require an additional $64,222 next year to account for the increased cost of electricity and heating oil.

- Purchased Services increased by 15%. The Solid Waste budget requires an additional $105,128 to pay for contracted curbside recycling services and increased tipping fees for trash disposal. An additional $99,228 is included in this year’s budget to account for Maine Water’s 18% increase in municipal water fees. Additionally, there is a $210,195 increase in User License Fees to update the City’s outdated computer software system.

- General Operating Costs increased by 9%. The Road Maintenance operating budget is up 18%. Due in large part to a spike in the price of road salt, the City will require an additional $89,500 next year to properly salt the roads after storms. The City will also need an additional $76,100 to provide General Assistance, specifically rental assistance, to eligible residents. Furthermore, a $184,601 increase is requested to update the City’s Computer Software, including MS365 and a fullscale refresh.

- Capital Improvement Plan (CIP) increased by 125%. The City Manager is proposing an additional $2,000,000 in CIP spending. This represents a 125% increase over last year’s $1,600,000. Such a significant increase could help the City address many lingering capital needs that have been neglected for decades. Potential projects include sidewalks, road improvements (complete streets), Community Center upgrades, Fire Station improvements, playgrounds, a pedestrian/bike bridge, Biddeford Ice Arena upgrades, sewer improvements, and ADA compliance projects.

It is clear that Biddeford is facing significant budget challenges for the upcoming fiscal year. The proposed increases in both the School and Municipal budgets, combined with the rise in County Tax, will result in a considerable increase in property taxes for residents. However, Biddeford is not alone. The City of Lewiston is facing a proposed 21% tax increase, and the City of Portland is facing a 9.3% tax increase. In contrast, Maine’s State Legislature has started to debate the nearly $1 billion in surplus revenue that the State expects to bring in over the next two years.

These budget challenges facing municipalities like Biddeford underscore the broken nature of our current tax system, which relies too heavily on property taxes to fund local governments, essential municipal services, and K-12 education. With the State sharing just 5% of revenues with municipalities and funding 55% of education costs, property owners are left to bear the burden of funding increases in operational and capital expenses, resulting in significant property tax increases.

Biddeford faces a unique challenge due to the State's complex and flawed education funding formula, as it covers significantly less than 55% of the total education costs. This disparity is particularly concerning given the high proportion of economically disadvantaged students (over 57%) in Biddeford who may require greater access to educational resources and support.

As Biddeford's municipal officials and city staff grapple with these funding challenges, I encourage residents to engage in the city budget process and provide feedback to the City Council. Municipal budgets are a reflection of a city's priorities and values, making it critical for residents to voice their opinions if they feel that their own priorities or values are not being adequately represented in the budget process. This is a crucial time for Biddeford, and your engagement and input will be pivotal in shaping our budget and ensuring that it aligns with the needs and desires of our community.

Liam LaFountain is a first-term City Councilor in Biddeford and a healthcare analyst at the non-profit Healthcare Purchaser Alliance. He welcomes questions, comments, and ideas and can be contacted directly at liam.lafountain@biddefordmaine.org.

The views and opinions herein are solely those of the author and do not necessarily reflect the viewpoints and opinions of Saco Bay News, its employees, publisher, or advertisers.